Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

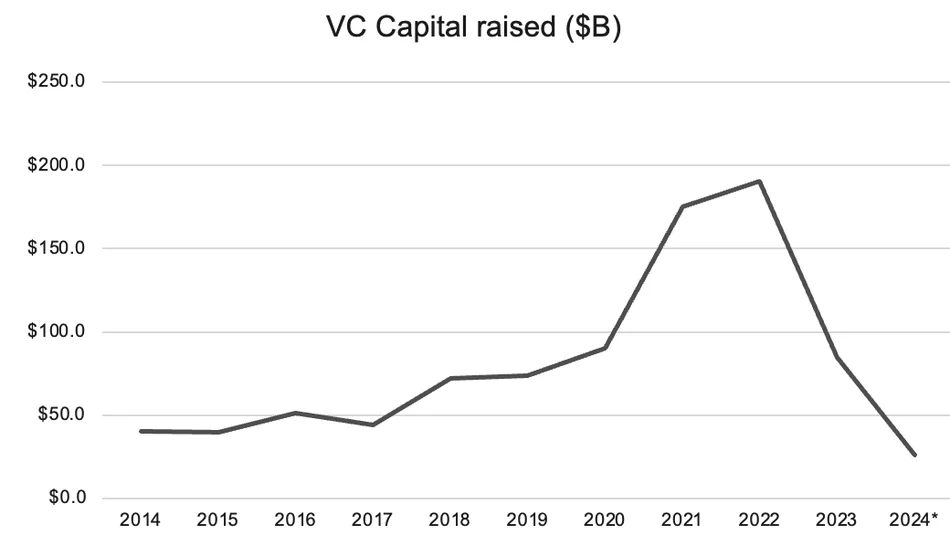

In our regular conversations, we often explain the structural implications of fund strategy in venture. LP capital flows into VC fluctuate with market cycles, which are subject to interest rates, risk appetite, and other LP allocation dependencies (e.g., denominator effect). Since, historically, prices/fees in PE/VC are inelastic due to structural norms (the standard 2/20 model), AUM is the dependent variable as the supply of LP capital increases (there is also an increase in the number of firms, but generally AUM concentrates into only a small number).

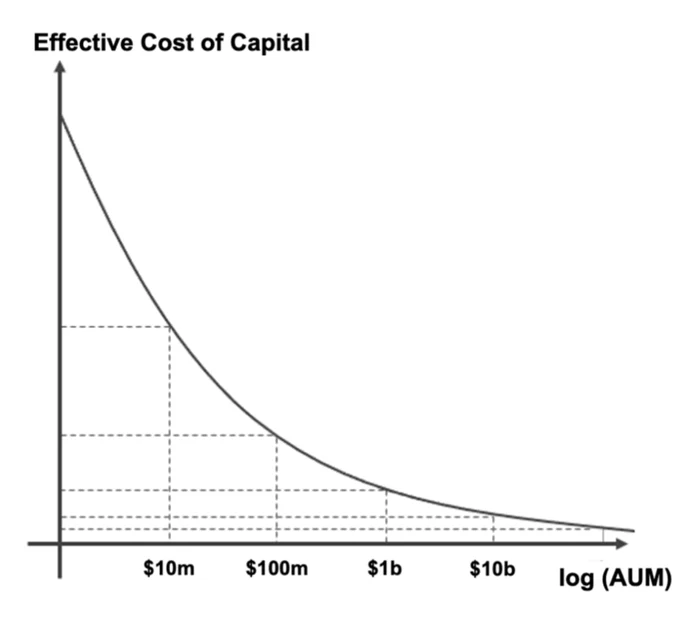

Generally in VC, investors expect a lower relative rate of return as companies mature through financing stages. While check sizes are small at the onset (pre-seed/seed), round sizes are significantly larger in later stages. As funds absorb more capital they need to either (a) expand to later stages in order to deploy more dollars, or (b) expand into other investment strategies, both which lower the blended cost of capital for investors. LPs that back these firms are implicitly accepting that lower rate of return (i.e., the mantra that “VC does not scale”). For VCs, this means the cost of capital typically decreases as AUM increases (thank you at @Tom Seo for the thinking and chart below).

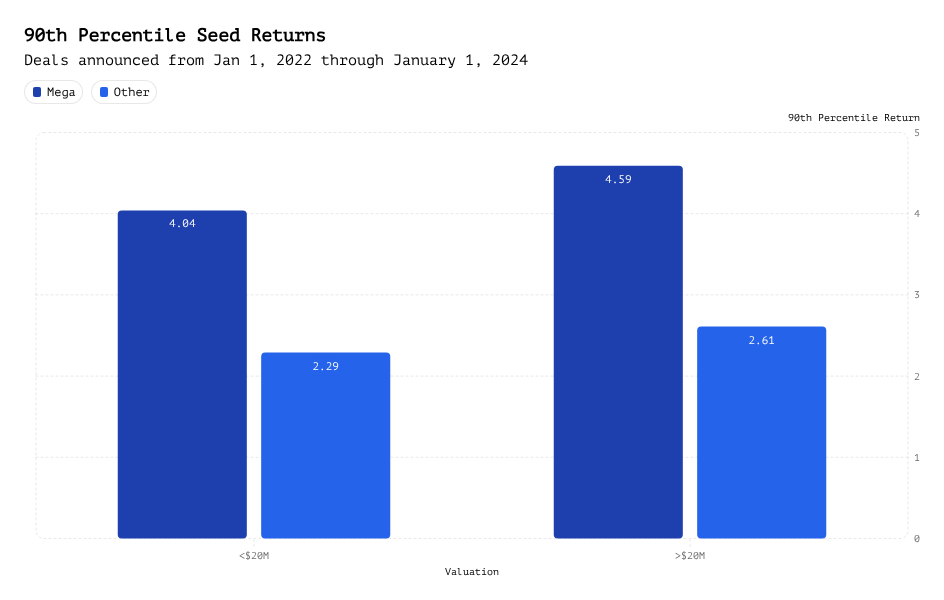

But this cost-of-capital game is a dangerous one to play. We look for firms who counterposition, and instead play a game focused on lower cost structure, rather than lower cost of capital, where the incentives are focused around carry. The underlying dynamics in VC are such that there is a pronounced power law distribution at pre-seed/seed. In order to simulate potential pre-seed/seed VC fund returns we use the piece-wise distribution developed by Jerry Neumann (see chart below).

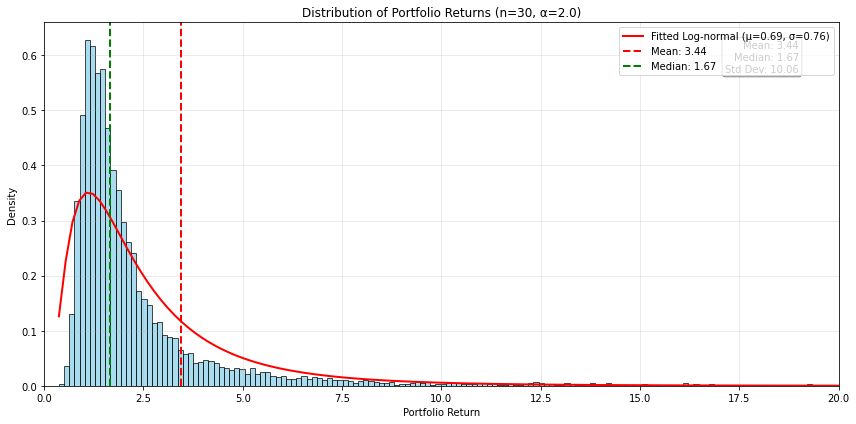

To highlight the impact on pre-seed/seed-focused fund returns, we sample portfolios with 30 companies and plot the distribution of fund returns. As you can see, the distribution loosely follows a log normal distribution, and there is a pronounced positive asymmetric skew with mean performance ~2x the median performance.

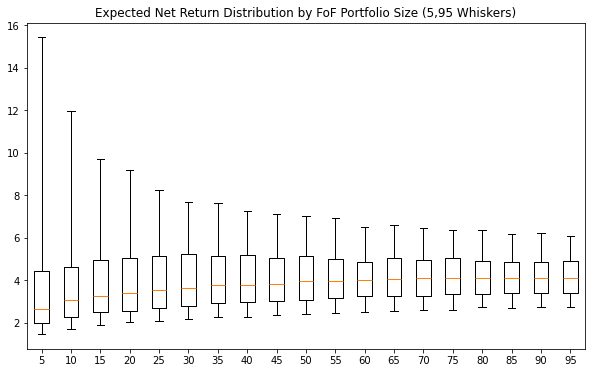

We now try and estimate the optimal number of pre-seed/seed funds that should compose a VC fund of funds. To do this, we sample funds above the median performance (50th percentile) and display a box plot with 5% and 95% whiskers (with returns net of estimated fees). We can see that, intuitively, the 95th percentile is optimized with a smaller number of funds, while the median grows slowly as funds are added. For a given fund of funds, high concentration would be ideal, however real-world constraints exists around investment capacity (size of LP commitment) and position uncertainty (confidence bounds). Thus, for instance a ~20 fund strategy would still provide upside but would also be more executable.

The median performance of the fund of fund portfolio significantly beats median performance of the underlying fund performance distribution (and is commensurate to the mean, even including estimated fees). Of course more “alpha” in sampling yields improved results (i.e. sampling from top quartile funds). We believe that selecting small pre-seed/seed funds with outlier potential and diversifying in a portfolio of funds is a great strategy in venture. Given that macro market cycles are unpredictable, this strategy also has the benefit of vintage (temporal) diversity as well as smoothing of capital contributions, which should have a net positive impact on long-term IRRs. We also believe that coupling the fund of funds strategy with early-growth stage co-investing can compress the j-curve and driver earlier DPI. See here for the full simulation code on the above.