Are You Getting the Volatility You Paid For?

November 18, 2025

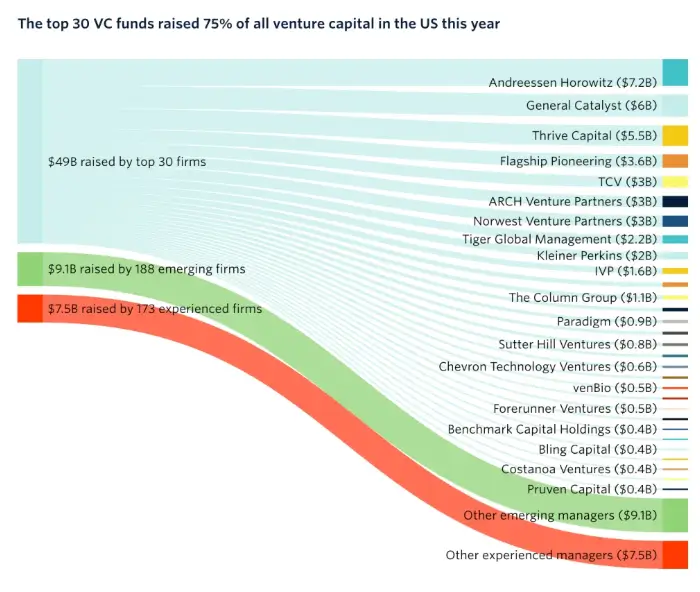

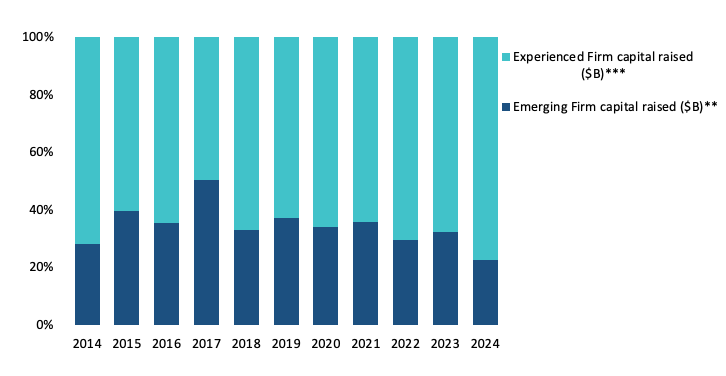

Adaptive Markets Theory, a theory laid out by Andrew Lo that claims a market is neither efficient nor irrational, argues that is essential to understand market participants’ evolving ecology and strategy in order to comprehend the state of the market. This is because specific investment strategies are not fixed but co-evolve based on which are successful – persisting – and which are unsuccessful – fading away. VC is no different. To level set, over the last several years, VC has become more institutionalized as the private tech markets have grown. LP capital flows ballooned and peaked at ZIRP when the Fed shifted away from ultra-low interest rates, and many LPs fled the market. Since then, LP capital has been consolidated into multi-stage platforms (a16z, etc.) as large LPs who want to maintain exposure to VC are comfortable allocating to established managers.

This “new regime” has put survival pressure on sub-scale and emerging VCs because deal counts have decreased despite the new AI wave, while the supply of capital has not (dry powder), leading to fiercer competitive dynamics. The net effect is a sharp decrease in first-time funds and capital to emerging funds. The counter reaction is that emerging VC funds must refine their strategies and approaches.

We view the competitive landscape as stabilizing to three archetypes:

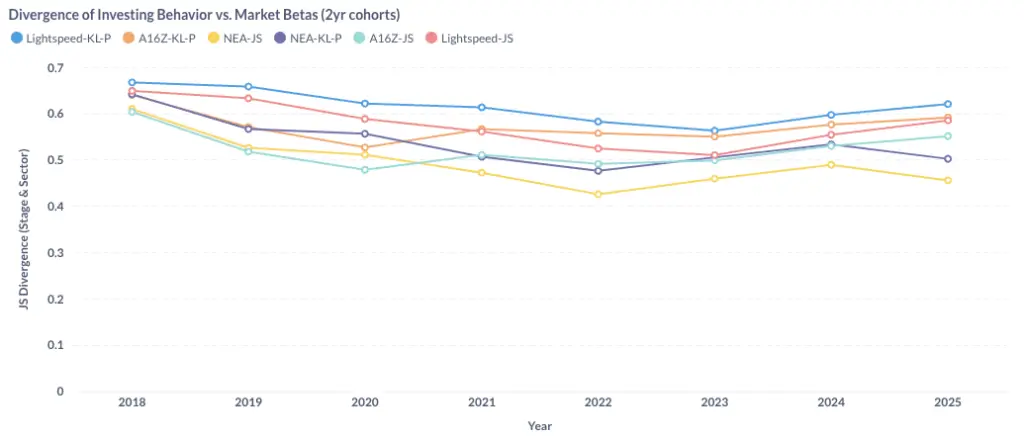

Let’s consider the above to be (roughly) accurate. The Smart Alpha strategy can only exist if emerging VC firms have a portfolio selection that diverges from firms in the “Beta” categories. One way to think about this is that since Smart Beta represents the largest concentration of capital (AUM), we can assess the potential for a Smart Alpha strategy by comparing the portfolios of emerging VC against the portfolios of Smart Beta. While this is not a perfect approach (as there are a lot of inefficiencies in the market), you can imagine excess returns existing where a strategy is materially different than Beta players at any point in time (pre-legibility). This is because if a portfolio has a legible signal, opportunities will be arbitrated by players in the Beta categories. Of course, the divergence from smart beta needs to be “correct” (i.e., not just different) since we would expect smart beta players to dominate any high signal companies downstream.

To illustrate the above, we categorized manager’s portfolios as a distribution across themes and stages. From that, we plot a manager’s KL Divergence (distributional distance) compared to the largest Smart Beta investors. The first chart represents a seed investor with a highly divergent portfolio in 2022, which has become increasingly less divergent since.

In the second chart, the manager maintained high divergence through a specialized sector strategy while maintaining stage/earliness discipline.

The takeaway is that Manager 1 had a unique strategy which has increasingly become more popular among Smart Betas, whereas Manager 2 has consistently had a divergent strategy from Smart Betas.

Of course, the charts above do not necessarily imply that the second strategy is better per se. However, it is fair to assume that there will be price pressure in the areas that are less divergent if the founders/companies are legible (unless the first manager discovers new alpha areas), which may boost competitive dynamics for Manager 1. That being said, there are still many reasons why an emerging VC may win in a competitive process with a multi-stage firm. Yet, they typically must meet the entrepreneur at similar valuations. As an LP, we use this framework to question whether the emerging VC has a strong enough network/knowledge advantage to accomplish such a strategy. We also believe that both Smart Beta and Smart Alpha strategies can work under the right circumstances and LPs will likely want to construct portfolios that includes instances of both.

Interestingly, the above also implies that the cycle time for alpha-generating strategies may be short-lived. This is likely a function of the rapid rate of change of both the underlying technologies (phase shifts) and the talent networks that drive them. This would impact the persistence of VC manager performance (as performance may be highly cycle dependent) and so prudent re-underwriting is essential.

Using adaptive markets as a lens by which to look at market, we can get a sense for how evolutionary pressures may impact strategies and ultimately performance.