Are You Getting the Volatility You Paid For?

November 18, 2025

Capital markets (VC included) are complex adaptive systems (CAS). As such, they exhibit various unique phenomena that make investing incredibly difficult and unpredictable. Some of the most important of these are: (a) emergent behavior (properties that cannot be predicted by analyzing individual participants), (b) adaptation and self-organization (market participants evolve their strategies based on feedback; participants organize without centralized control), and (c) non-linear dynamics (feedback loops, path dependency, power law distributions, small perturbations in complex systems cascade into large-scale reorganizations).

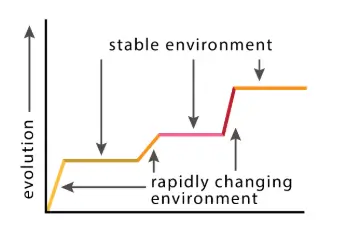

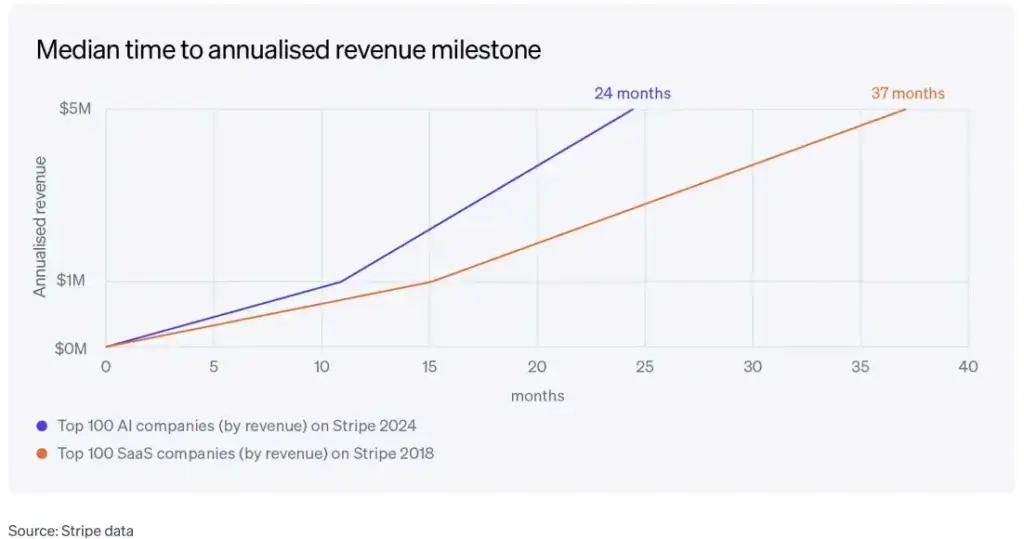

An important and related phenomena in CAS is punctuated equilibrium. This phenomena exists when a system is in meta-stable state due to organizational inertia, network effects, or entrenched norms (e.g., certain technologies persisting despite incremental improvements in alternatives), and then some unexpected catalyst puts enough pressure on the system to exceed its resistance—creating a phase transition. In the context of technology innovation, punctuated equilibrium can occur via some exogenous shock (e.g., global crises, regulatory changes, geopolitical changes, tariffs, etc) and/or, endogenously, when technology reaches some critical performance threshold (i.e. LLMs). This punctuation generates accelerated adoption and reorganization around a particular set of new technologies or markets. As such, startups and existing companies use the opportunity to chase the new opportunities created by these transitions. Since most networks underlying CAS typically operate near criticality—these rapid changes can yield “winner take all” and/or power law outcomes, where early winners can dominate market returns in the long-run.

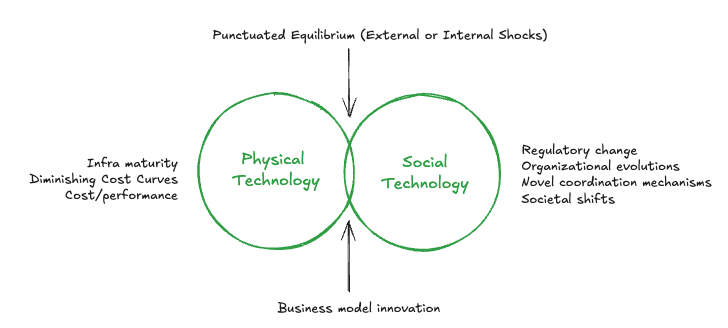

One can argue that a large majority of the historic value creation in VC has been driven by moments of punctuated equilibrium (examples below). Indeed, this is an important catalyst that allows for startups to break into markets previously possessing very high barriers to entry. One way to understand this phenomenon a bit better is to think about tech innovation as the interplay between Physical Technology and Social Technology (for more on this we recommend this great book). While Physical Technology describes the combination of technologies that harnesses physical phenomena to solve human problems (software/hardware/fundamental science), Social Technology refers to the organization of people to achieve some purpose or objective.

In this context, punctuated equilibria reshape the dynamics between Physical and Social Technologies in two important ways:

It is important to note that as in all markets, investment activity aimed at exploiting punctuated equilibria is highly influenced by capital flows, which can have interesting impacts on value-creation and destruction during these phase shifts. For instance:

While VC’s welcome punctuated equilibrium events as opportunities for large value creation, it is important, as investors, to have a view as to how capital flows distort signal early on. While being early to a punctuation event is ideal, it is also important to have a viewpoint around long-term pricing power and future market structure.