Are You Getting the Volatility You Paid For?

November 18, 2025

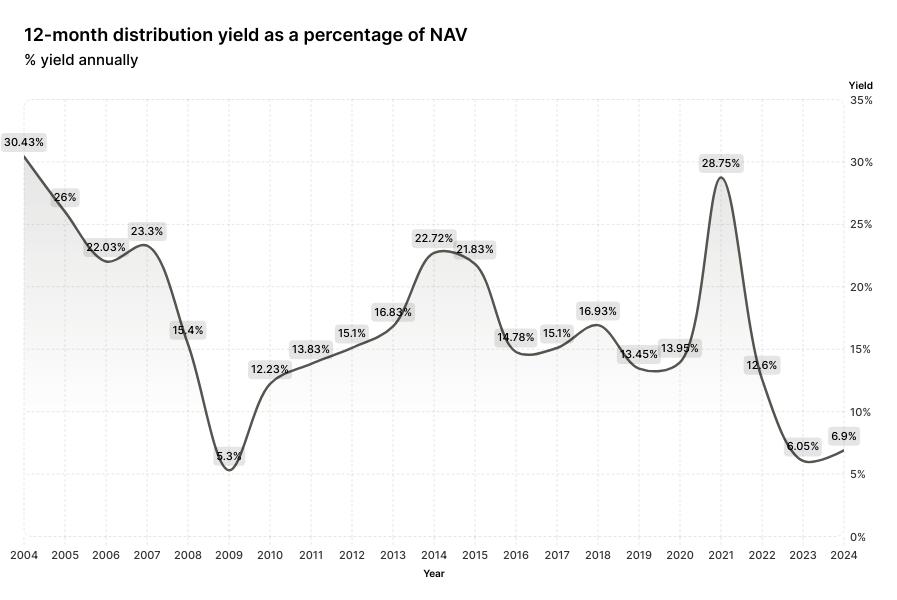

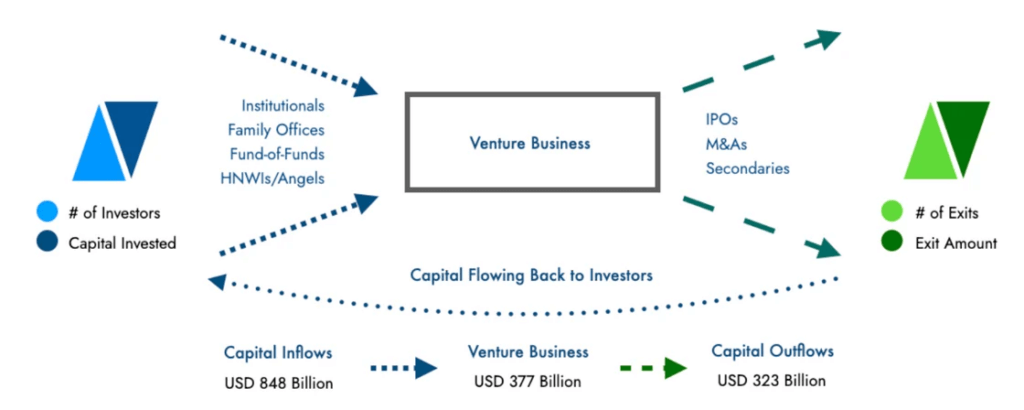

Many investors these days are discussing the current liquidity crunch in VC, in the backdrop of an uncertain and volatile market. One data point we keep hearing about is the lack of DPI, and questions as to whether this DPI glut is temporary or an indication of a more persistent, structural issue. To track DPI, we can look at the US VC trailing twelve-month distributions relative to NAV (NAV being the percentage of total VC AUM which is not dry powder, PitchBook). There is certainly a pronounced decline in yield commensurate with GFC levels.

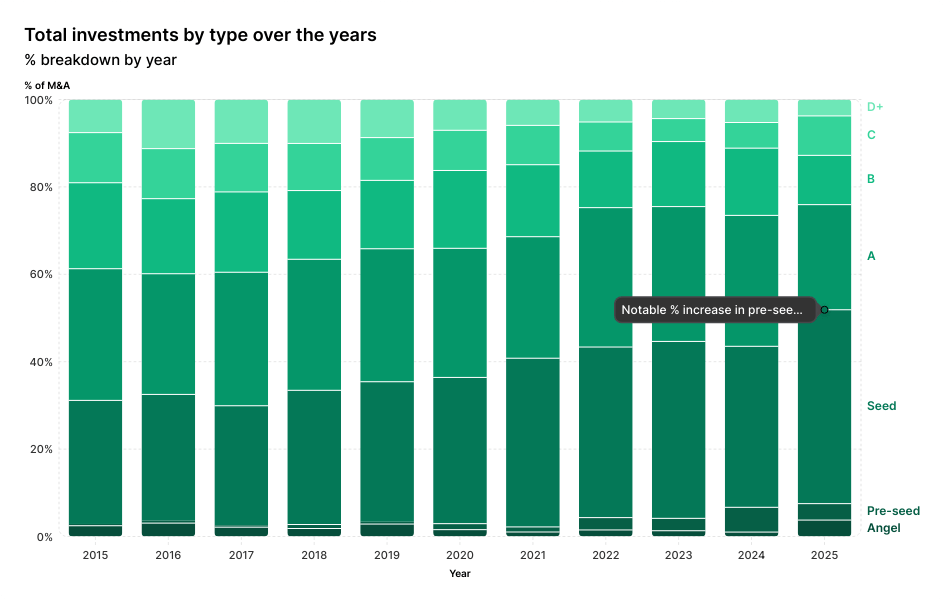

The current paucity of DPI seems to be related to several conflated factors including: (a) companies staying private longer (access to private capital, less regulator burden, founder control), magnified by a closed IPO market (due to uncertainty and market volatility in the public markets), (b) a decline in M&A since 2022, due to macro uncertainties, higher interest rates, and regulatory scrutiny (anti-trust, national security review, data/privacy), and (c) “hangover” from 2020/2021 ZIRP vintages which created inflated fund NAVs (valuations) due to massive LP capital flows, which are yet to be returned. Regarding (b) while M&A has certainly declined, there has nonetheless been signs of life in smaller outcomes. The chart below shows a growing percentage of pre-seed/seed/Series A companies being acquired, which is likely due to less regulatory scrutiny for smaller transactions and strategic acquisitions capitalizing on a more difficult fundraising environment.

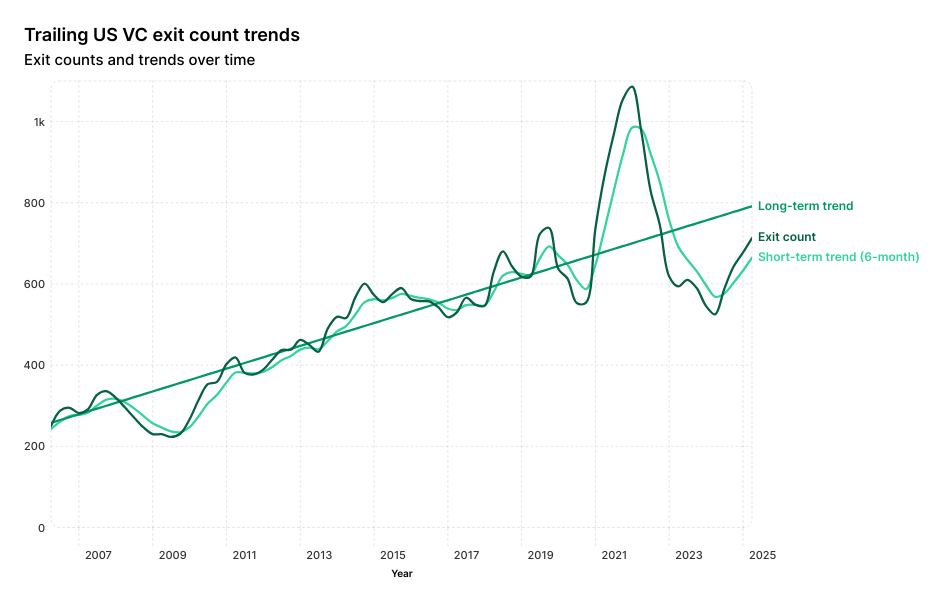

In addition, exit counts seem to be reverting to the long-term trend, a positive leading indicator of recovery (see below). Of course, exits need to increase quite significantly in order to compensate the large amounts of LP capital stuck in the system. But, in reality, much of the older NAV will likely need to be downward adjusted in the short- to medium-term.

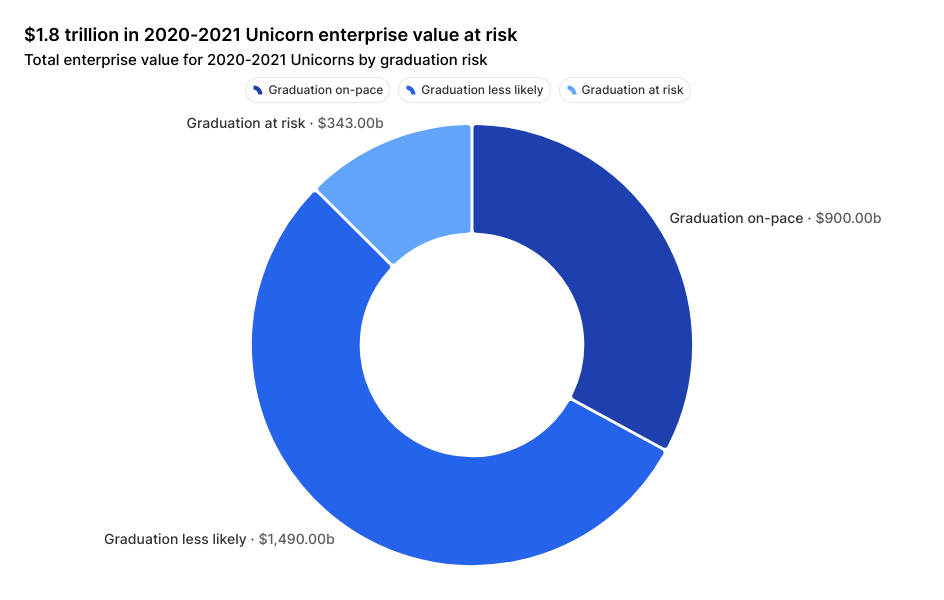

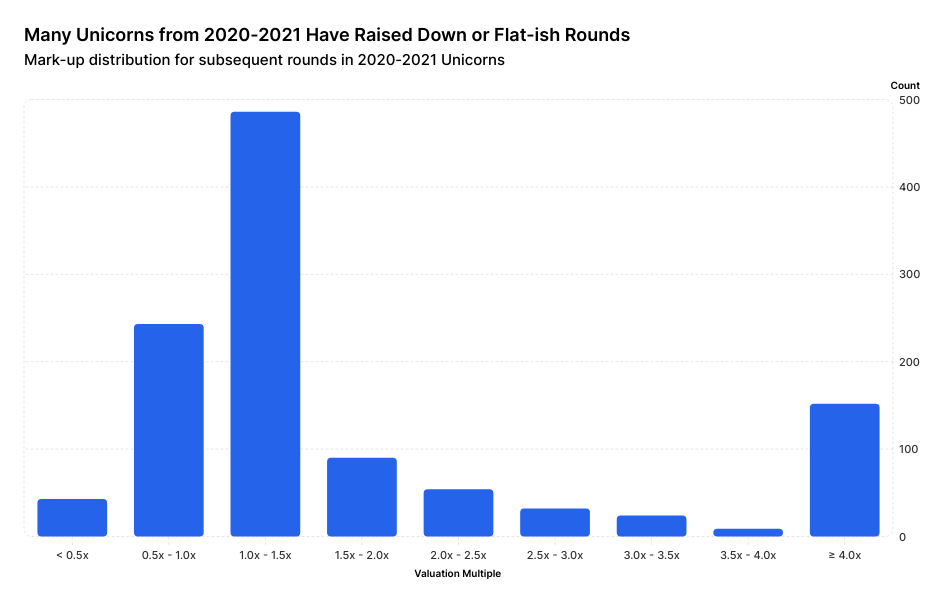

That is, with regards to (c) above, we believe that the market is yet to be fully corrected from 2020-2021 vintages. The market has avoided a deeper correction probably due to company balance sheets as well as the large amounts of dry power that have kept many of these companies from going back out to market (there are incentives for GPs to keep high marks as long as possible, which is why Level closely monitors graduation risks and secondary transactions). Inevitably, these companies will be forced to reprice, exit, or shutdown — and likely soon. Based on Level’s data, we estimate that there are ~1000 or so unicorn companies from 2020-2021 at potential risk of down-rounds or repricing (based on close to ~1,700 unicorns in our data). Below we show the distribution of total enterprise value by risk category.

In addition, many of the 2020-2021 unicorns that are on-pace graduated with down-rounds or flat-ish rounds (see below).

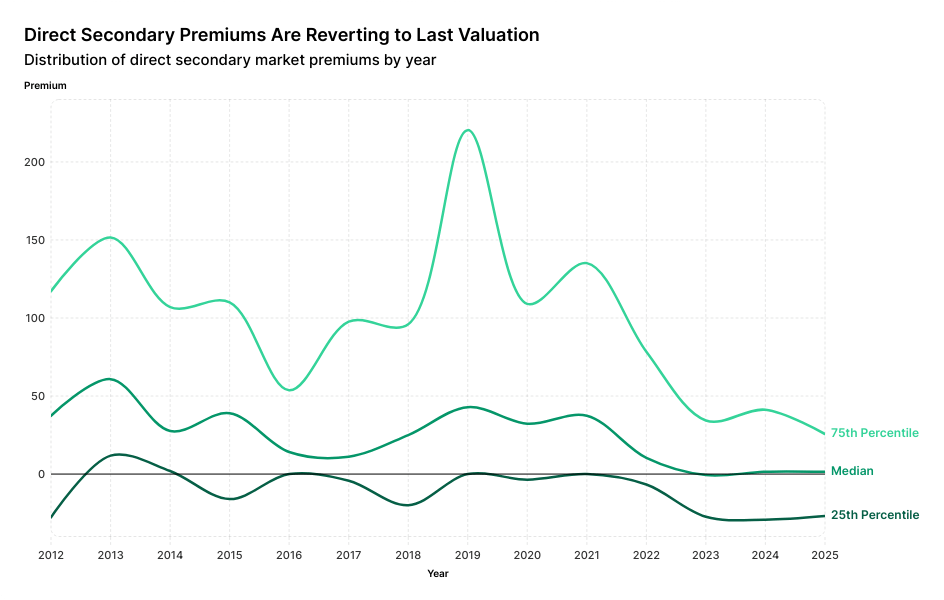

To compensate for the liquidity crunch, the secondary markets have increased in size and volume, with more transactions in direct secondaries as well as large secondary funds being raised to purchase LP positions or setup continuation vehicle or special situation-type transactions. As parallel to the growth in volume, Level’s secondary data shows that the premiums/discounts in secondary directs have reverted to latest marks (see below). We believe, as the secondary markets continue to mature, there will be various options for GP/LPs to liquidate their high value assets, and a secondary strategy will need to be a thoughtful part of LP’s/GP’s toolbox.

It is important to understand that because of the structural nature of VC (close-ended, 10+2 fund model), the delay in mark-to-market valuation adjustments, and dry powder overhang, there exist both positive and negative feedback loops. In times with excess LP capital flows, there is valuation reflexivity (more money → higher company valuations → higher VC TVPIs → more LP capital flows). While, in market reset periods, it takes time for portfolios to adjust and reprice. The structural nature of venture capital structures provides that the past persists into the future.

Despite the tension in the venture capital cycle, venture capital itself, as an industry, is changing (i.e. what some call Venture 3.0). For LPs, it is important to be highly aware of these changes and adjust accordingly. Rohit Yadav at Rethink recently published a great, in-depth analysis on the industry called Rethinking Venture Capital. We think several takeaways are highly relevant in today’s world:

We are building Level to align with Venture 3.0., as a core investment platform aimed at providing unique, risk diversified exposure to the edge of technology innovation, by developing unique investment strategies and leveraging AI and technology to drive sustainable investment edge.