Are You Getting the Volatility You Paid For?

November 18, 2025

In prior updates we discussed the evolving nature of alpha as well as our Criticality Investing framework. We argued that traditional sources of alpha in VC are being systematized and arbitraged away by smart beta multi-stage firms, so emerging VC managers must dig deeper for new edges. While in Criticality Investing, we articulated a framework that focuses on “latent tensions” in markets, the catalysts that subsequently trigger their release, and how resulting narratives (if the catalyst is strong enough) stimulate capital rotation. We believe Criticality Investing is an alternative to trend following and/or the extrapolation of n-th order predictions that investors will naturally converge to (more on this below).

These topics (alpha and criticality) need to be understood in the context of today’s market dynamics. Markets have generally become less efficient over time (we recommend reviewing this great whitepaper by Cliff Asness from AQR). This sustained inefficiency is driven mainly by (a) technology (explosion of technology and social media has made information more accessible but also more overwhelming and prone to herd behavior), (b) the impact from increased indexing (passive investing) and (c) a prolonged low interest rate period.

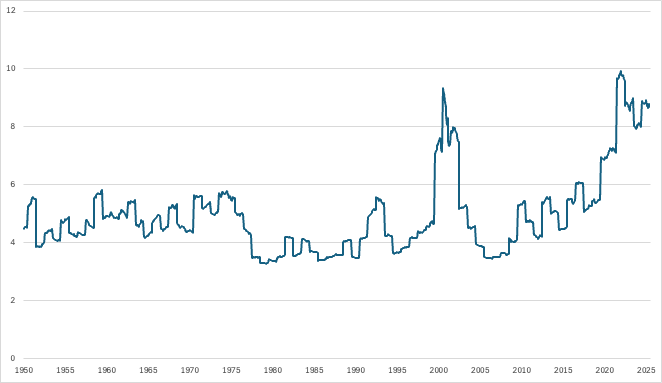

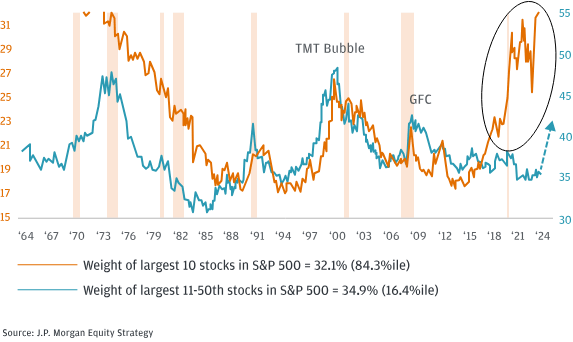

Value spreads can be used as a practical indicator of market inefficiency—when the spread is unusually wide, it suggests that expensive stocks are extremely overvalued relative to cheap ones (see chart above, calculated from FAMA data on the spread between high to low book-to-market value companies, as in AQR paper). Historically, value spreads were stable, but in recent decades they have become much wider and have stayed elevated for longer periods (notably during the dot-com bubble and the 2019–2020 period). Persistent, extreme value spreads signal that the market is mispricing stocks more severely for longer durations—evidence of declining market efficiency. In a prior update we discussed one possible driver: passive investors creating price-inelastic demand (with passives being a larger part of market activity, markets respond to changes in fund flows, divorcing prices from fundamental values). We showed how this is mirrored to some degree in venture capital, with the bifurcation of the market into Smart Beta and Smart Alpha.

When markets are inefficient, price discovery becomes unreliable and complex, highly driven by capital flows (versus fundamentals). When capital flows are the ultimate driver of price (as in inelastic or flow-driven markets), narratives becomes a primary driver of behavior. And since powerful narratives are reflexive, capital becomes concentrated in power law outliers (we see this with concentration in the public markets). Note that this also has a large impact on fundamentals in winner take all/most markets, especially where access to talent and capital is competitive.

With fewer active participants able to correct mispricings, these narrative-driven moves can persist longer and become more extreme. In this context, it is critical to understand how narratives form and how overly coherent narratives might obfuscate reality.

Market narratives are collective phenomena—narratives form and crystallize in a decentralized and distributed way—they emerge organically from the collective beliefs, communications, and direct/indirect actions of many participants. One way to understand the narrative formation process is through prediction games in higher-order forecasts (great post by Michael Dempsey at Compound here). Higher-order prediction games are systems where participants make forecasts about the future and also about the behavior of forecasters themselves. For instance in the case of AI + Robotics:

In prediction games in markets, predictions are correct when capital agrees. Of course, farther out predictions are considerably more noisy and uncertain, with predictions changing as new information becomes available. The point here is that to be right as an investor, rather than squarely predicting the future, one needs to predict what will be the consensus opinion expressed by capital flows. The real advantage may now lie in understanding complex, second- and third-order effects better than other investors. In addition, one needs to predict more intelligently/quickly than the market, as the following consensus collective n-th order reasoning will limit available alpha. To the extent that market stay inefficient for long periods of time, this is the game to be played on the field.