Are You Getting the Volatility You Paid For?

November 18, 2025

In a prior update, we discussed Smart Alpha vs. Smart Beta in VC. We explained that as the market continues to institutionalize and mature, it bifurcates into Smart Beta investors—large, multi-stage platforms investing in legible, momentum companies—and Smart Alpha investors, typically smaller VCs seeking unintuitive opportunities that can become massive outcomes if they prove legible. In a recent interview, Rob Go refers to a similar split, which he calls super compounders vs. weird. An additional angle to understand these strategies is through the lens of volatility.

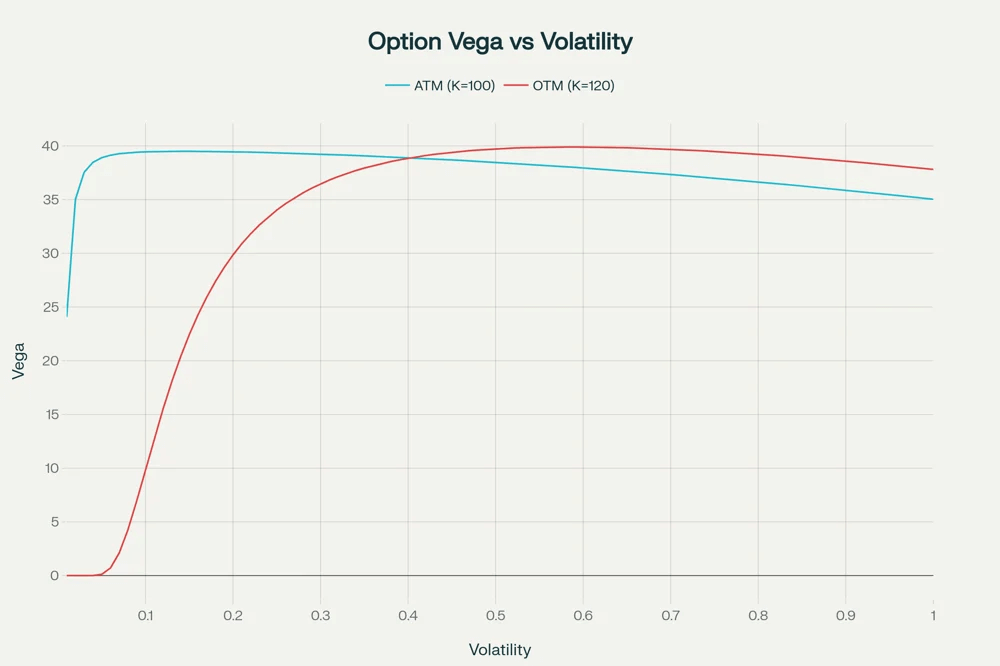

Early-stage startup investments can be thought of as real options—specifically, out-of-the-money call options. Real options provide the right, but not the obligation, to invest in a future opportunity—capturing upside while limiting downside (note the difference between having pro rata rights vs. not). One of the key value drivers of a real option is volatility—the spread in the range of outcomes. In fact, what early-stage investors are really buying is volatility (uncertainty). As an illustration, below we plot the vega (sensitivity of option value to volatility) of two real options: (a) an at-the-money (ATM) option (lower cost) and (b) an out-of-the-money (OTM) option (higher cost). Option (b) requires greater volatility to increase its value.

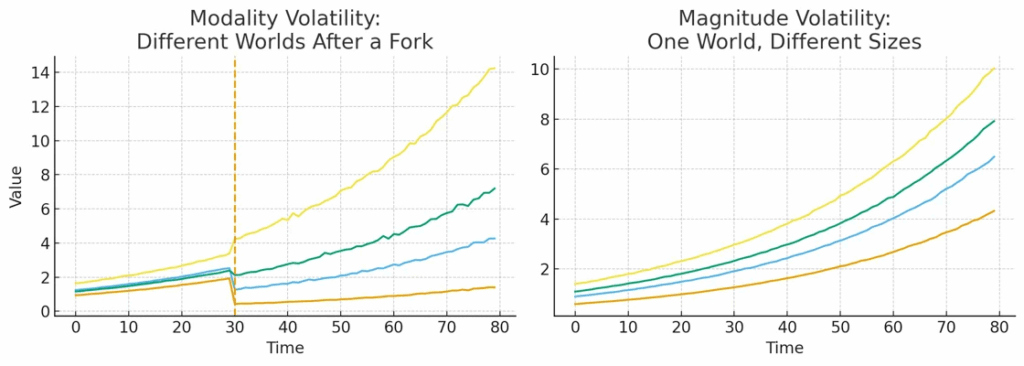

But not all volatility is equal. The nature of volatility is shaped heavily by competition and crowding. For super compounders, where valuations are typically higher, the scale of outcome can be deep in the power law, but the range of outcomes (volatility) narrows as traction increases legibility, accelerates information flow, and attracts competitive capital. These dynamics compress the distribution of outcomes. Contrast this with the weird strategy, where volatility is driven by existential risks (“does it work?”, “will anyone buy it?”, “is this a real market?”, “is this team capable?”).

Highly competitive markets erode volatility in several ways:

Investors should be careful not to pay for more volatility than they are actually getting. To extend the analogy: In super compounder markets (akin to Smart Beta), returns are size-based (magnitude or scale of outcome). In weird markets (typically Smart Alpha), returns are mode-based (fundamental uncertainty and convexity).

In pre-legible opportunities, option value is highest: idiosyncratic outcomes, low macro correlation, high variance, power-law bets. Prices do not fully reflect the breadth of potential outcomes, so you gain exposure to multiple possible worlds before the market “collapses” into one reality, while valuations remain low relative to the true range of outcomes. At the earliest stages, alpha is about convexity, not certainty. In emerging VC strategies, the super compounder approach can create real value, but it favors Smart Beta investors (who have the scale/brand to concentrate capital into a few companies)—happy to pay for magnitude rather than modality.