Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

In our last update we discussed the nature of semiotics in capital markets. Specifically, we discussed how capitalism operates by coordinating market activities through symbolic abstractions—like money, securities, and prices—which simplify complex, uncertain futures into transmissible narratives and concepts. These abstractions, often layered and recursive, can diverge from material reality for long periods of time.

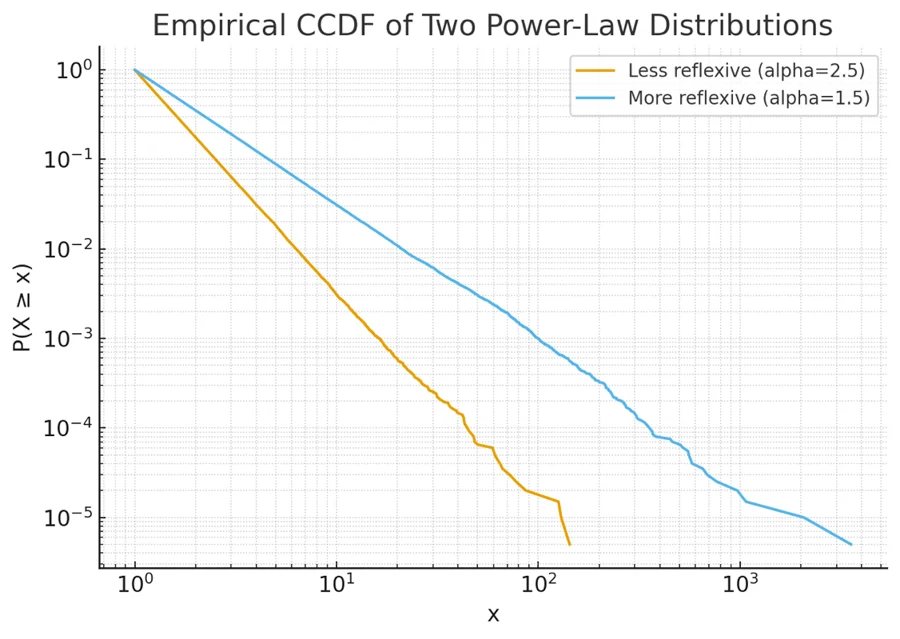

There is another more “meta” aspect to consider: the extent to which the material/fundamental reality “out there” is truly independent of our perceptions. In reflexivity theory, perceptions and beliefs actively shape reality, creating recursive feedback loops where observation influences outcomes (i.e. the line between perception and reality is a loop, see figure above). When markets are in a high reflexivity regime, especially during punctuated moments of change, they cease to function as effective valuation engines. Instead, as they explore/exploit possible futures, they become coordination systems for collective beliefs and worldviews. When reflexivity is pronounced, this leads to maximally converged beliefs and concentrated markets (where few players dominate), magnifying the extreme tail affects of power laws (see plot below).

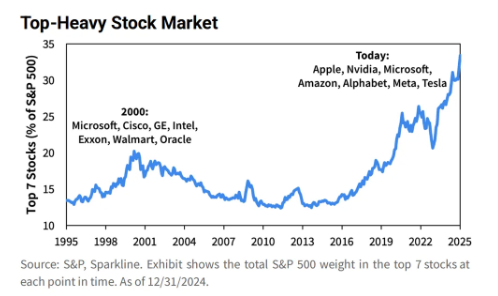

While power laws themselves are scale-invariant, large capital flows also result in more magnitude and scale for the winners (since the pie is larger). And as the cycle of scale continues, concentration and oligopolistic (”few-take-all”) competitive dynamics reflexively influence fundamentals for the whole market (i.e. the “tail wags the dog”). Markets then become sensitive to the activities of a small few players—influence and narrative becomes concentrated—even if prices are far from optimal.

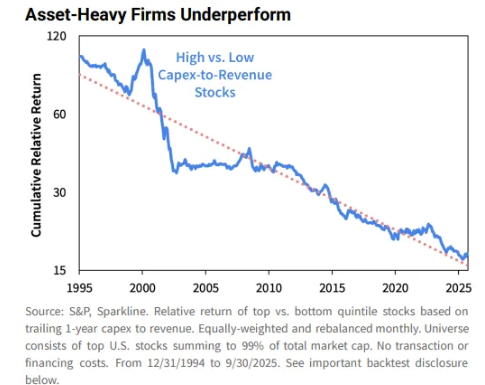

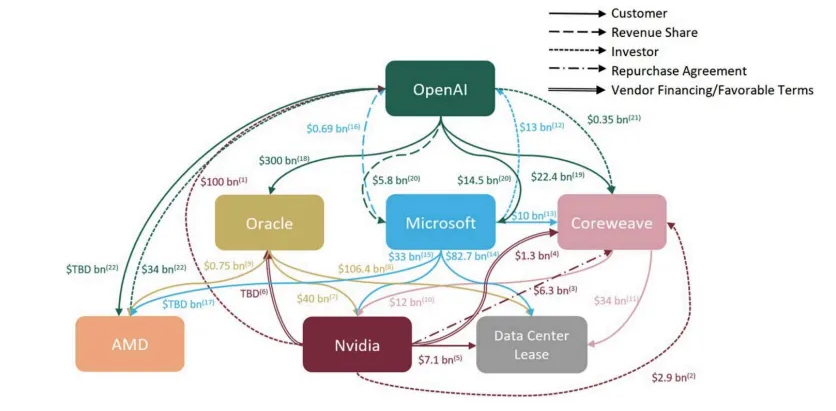

This is the state of the market today, where competitive dynamics (i.e. no hyperscaler can afford losing the race) have generated a massive CapEx data infrastructure spend (currently at 3-5% of GDP). At the same time, concentration in the market is extremely high by historical norms (magnified by passive investing, for which every $1 in passive is $5 in market cap).

This highly concentrated market setup generates reflexivity loops at many scales (economy, thematic, sector, company level):

For startup investing, the question is what will “win” in the long-run, post-CapEx market cycle. We know from history that lasting value from infrastructure bubbles typically accrues to users rather than builders of new platforms. In startups, this means that massive investments in LLMs or compute often subsidize the next wave of application-layer companies. Those companies need to position themselves to have durable, long-term pricing power.

We believe the best framework to asses startups in a highly reflexive market is by understanding the validity and durability of reflexivity loops (trying to unbundle long term power from short-term rents). As reflexivity can be both an accelerant as well as a “head fake” investors should think about the durable power (pricing, margins), expectations around market structure (winner-take-all, diminishing returns), and capital and talent dynamics (capital and talent flywheels)—and not just rapid (sometimes unprofitable, unsustainable) revenue growth (see Yoni Rechtman’s here).