Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

Many of the most lucrative investment opportunities often lie hidden in plain sight, masked by mounting market tensions that few recognize.

Financial markets, like other complex systems (earthquakes, neurons in the brain, etc), self-organize towards criticality—a metastable state between order and chaos, where tension is suppressed in the system’s underlying structure. Suppressed tensions build and are then released by catalysts (crisis, technologies surpassing price/performance, regulator changes, etc), which can drastically impact the flow and rotation of capital, and thus returns.

The nature of the tension→catalysts→release process in financial markets is more dramatic than other systems because investors are *agents* with perceptions—they adjust their beliefs and strategies based on their own information and what they believe others believe (reflexivity). When tensions are strong but not widely recognized, a catalyst can create large, asymmetric returns for select insiders who are well-positioned. Post-catalyst, investor perceptions can become self-reinforcing as capital flows increase and returns become recursive and detached from reality, which can lead to widespread investment losses when the energy runs out.

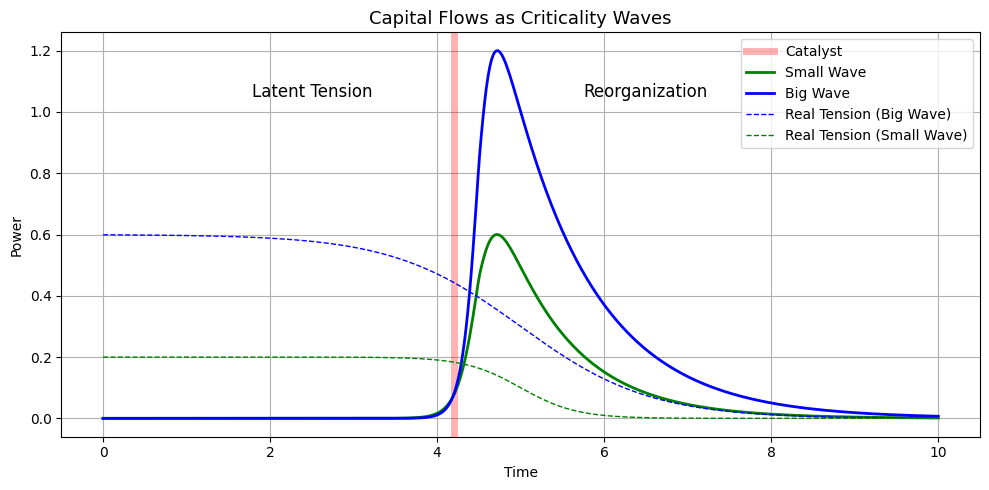

What makes investing both exciting and challenging is that the seeds of change, and thus the potential of outsized returns, already exist, but often remain latent and imperceivable to all but a few. We think of criticality like a wave. Imagine two distinct waves, one large (blue wave, below) and one smaller (green wave, below)—the flow of capital and subsequent market re-organization is proportional to the intensity of the tension “revealed” by the catalyst (dotted lines) and the strength of the investor perception/narrative that is generated (see here for more technical simulation). The waves decay at varying rates when tensions are resolved (note that meta-waves like cloud computing or AI can last for decades).

Certainly, analyzing an investment requires a fundamentally different approach depending on where you are in a criticality wave. For instance, there are difference in the analysis of convexity of returns, valuation dynamics, competition and market structure, capital and talent flows, penetration curves, etc.

We refer to this as Criticality Investing and believe it generalizes ideas from punctuated equilibrium, adaptive markets, non-consensus investing, complexity economics, etc. As an early stage investor this means assessing tension in addition to opportunity/TAM, catalysts and world states over forecasts and extrapolation, structural analysis instead of technology innovation, and welcomed volatility over certainty and de-risking.

Over the next few weeks we plan to publish more details around these ideas and some of the related data initiatives we are working on.