Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

Investors have long thought about how to judge a founder’s previous work history. At Level, we’ve put together a new metric that our entity-resolved and time-series-resolved data set shows to indicate future success.

Specifically, we aimed to quantify “earned experience.” Although still a work in progress, our first attempt was to take the maximum valuation delta on a founder’s resume. More explicitly, we have constructed a score that answers the question: for each work experience on a person’s resume, calculate the company’s valuation change during their tenure and return the maximum change across all experiences as that person’s score.

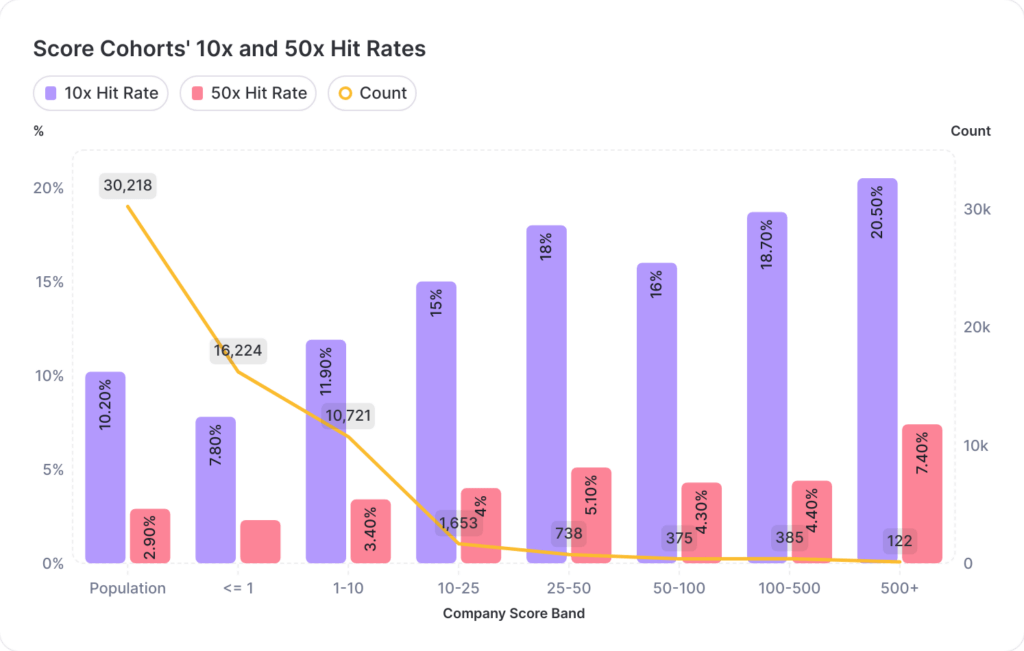

Looking at first investments (first financing round) into founders’ companies, we found a statistically significant relationship** between a higher company* score and a higher 50x multiple hit rate. The dataset for this analysis is 30,000 rounds between 2010 and 2018 that raised >$500k.

* Company score is the maximum founder score across all founders. ** The relationship is log-linear and we tested this hypothesis with a logistic regression (p < 0.0001).

A few takeaways:

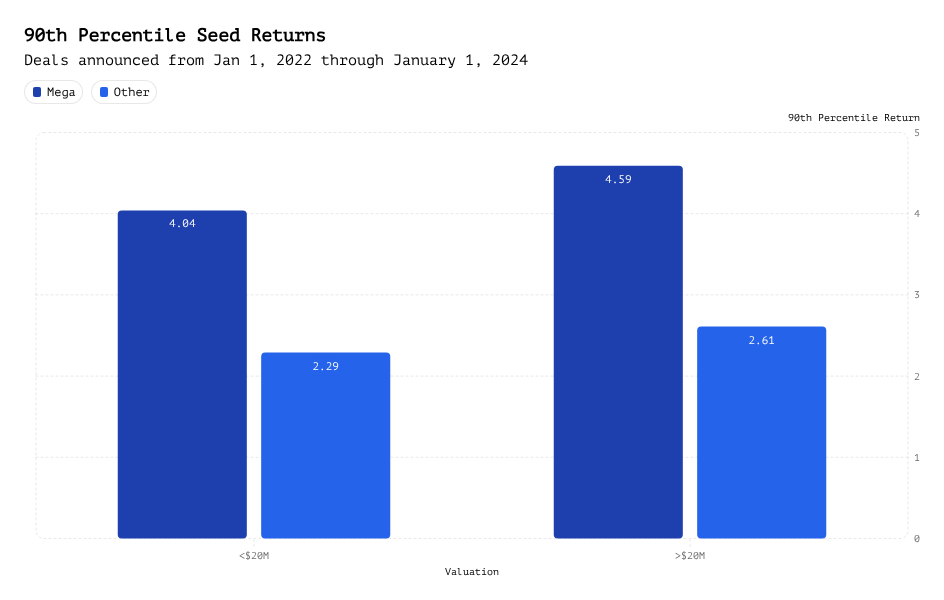

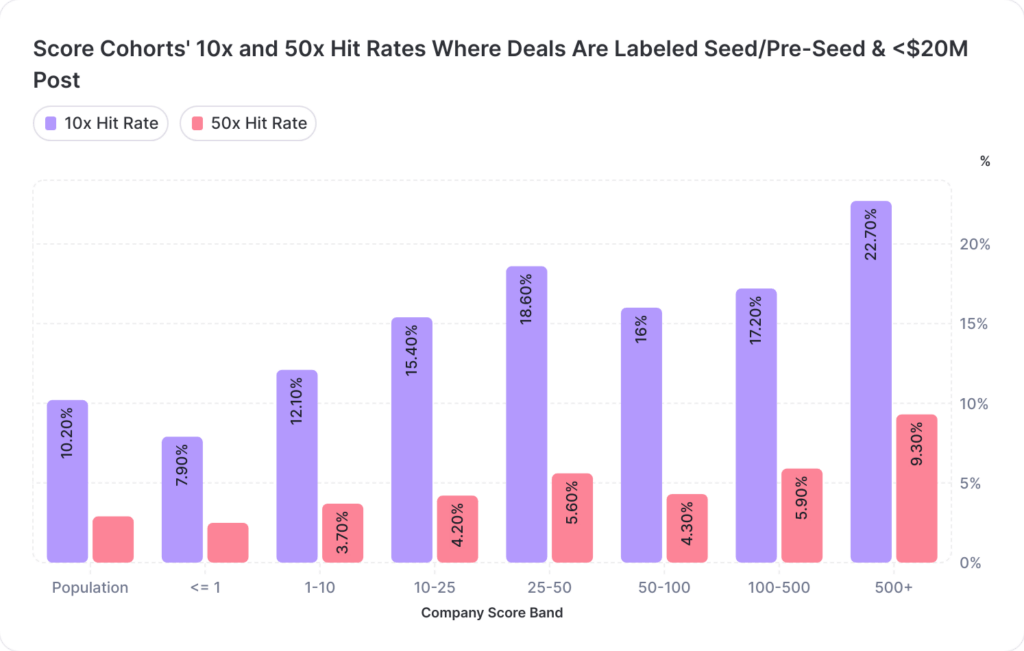

If we further segment our data to the first investments into companies that were labeled as a seed or pre-seed deal and had a post money below $20M (see our last post on valuations), we see that the trend continues to hold. Note that the sample size in the higher bands decreases, leading to a slight unevenness.

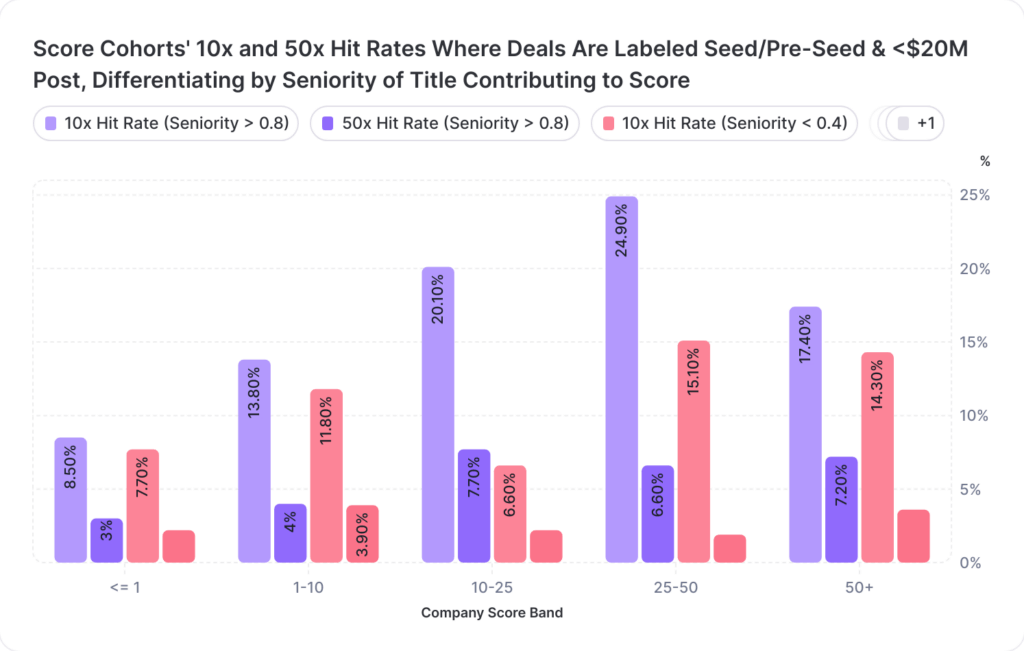

In addition, we also investigate how coupling seniority in past experience with founder scores influence future performance. To assess role seniority, we built a classifier that scores roles approximately between 0 and 1, whereby lower scores represent lower level contributions like interns and assistants, while higher scores represent executives, founders, and board members.

Below are examples of our model in action on some titles to give you a sense of the models’ outputs:

| Title | Seniority Score |

| Consultant | 0.15 |

| Project Manager | 0.29 |

Founder, Chief Executive Officer & Chairman | 0.88 |

| Advisor | 0.42 |

| Software Engineer | 0.14 |

| IT Specialist | 0.12 |

When we factor in the founder’s prior role seniority (maximally scored founder across all founders for a specific company), our data suggests that seniority additionally impacts future performance.

Based on Figure 3, the primary takeaway is that the 10x and 50x hit rate tends to be higher for individuals with greater seniority (Seniority > 0.8), suggesting experience plays a crucial role in generating successful deals.

At Level, we’re working on incorporating these scores into predictive metrics for future performance of investors. In addition, we’re building tooling using these scores for our fund managers to help them source new founders and recruit for their portfolio companies and weaving in more factors (open source contributions, academic contributions, and relevancy of previous experience to new company) to build an even more predictive “earned experience” score.

As for the analysis above, the TLDR is that while large venture outcomes are extremely infrequent given the venture capital Power Law, this study suggests an advantage for companies with founders who experienced success and impact at their prior companies. The scoring metric above can also be used to discover less obvious founders by focusing on spin-outs of non-brand name unicorn companies.