This is Not Your Mother’s Alpha

June 26, 2025

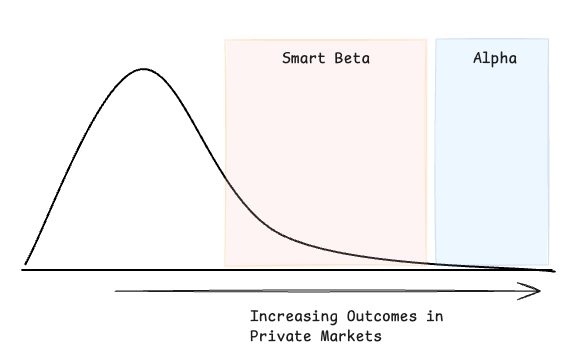

Data-driven algorithmic decisions now make up 75%+ of public market trades — an AUM of $1+ TRILLION.

But that wasn’t always the case.

Hedge funds drove this revolution back in the 90s, leveraging the parallel explosion of available datasets and computing power.

Now, 30 years later, the data-driven revolution is making its way into the world of venture capital.

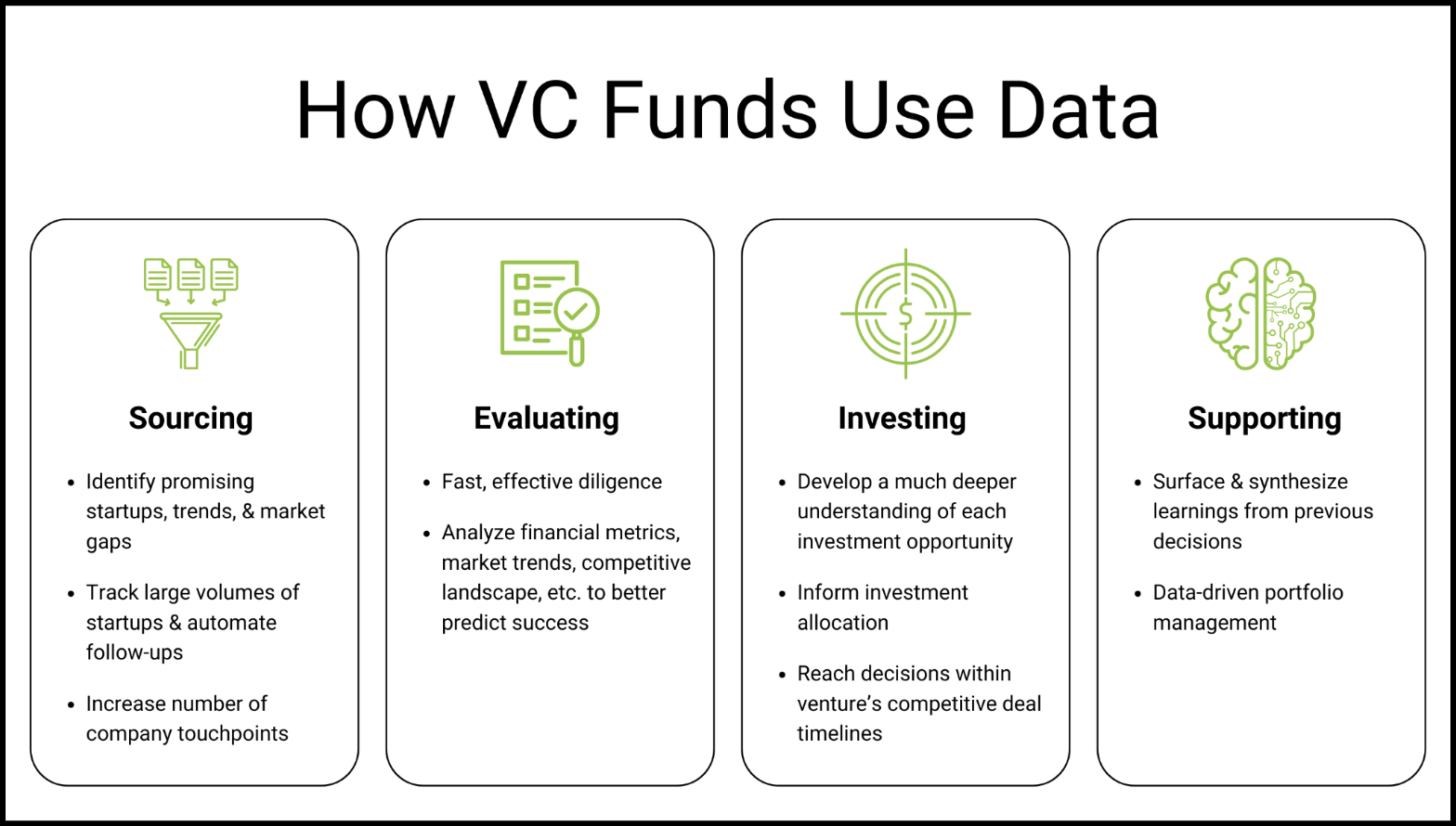

It’s happening fast. It’s estimated that more than 75% of VC deal reviews will be informed using AI and data analytics by 2025. VCs increasingly leverage data for sourcing, evaluating, and managing their investments.

In this post, we discuss why the timing is right for data-driven ventures, the specific strategies being used by funds today, and the trade-offs to consider. As always, you’ll hear directly from practitioners at the edge of this field.