Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

It is important to assess the potential impacts of AI on software and software-based business models. The “SaaS is dead” narrative circulating in market implies that, with the rapidly decreasing cost of (complex) software creation due to LLM code generators, traditional SaaS businesses will face competitive pricing pressure from new/homegrown solutions and thus suffer compressed multiples. In addition, there is a noted invisible asymptote with regards to the TAM potential of SaaS businesses. In his post on the subject, Matt Brown discusses the competitive dynamics in vertical software where, over time, winning companies have succeeded by offering a broader and more complex product suite for a vertical (for instance incorporating embedded finance and payments services). This broadening of the product strategy has two benefits: (1) it helps startups differentiate against incumbents, and (2) it helps expand the addressable market by increasing the revenue each customer can generate. However, he argues that even this model will hit decreasing returns (asymptotes), capturing a fraction of a particular vertical’s overall value.

These days, startups are leveraging native LLM/agent-based products to expand TAM by integrating with external relationships (customers, vendors, users) rather than only with internal processes and workflows. That is, these new business models subsume external revenue generation and cost reduction efforts, driving revenue and productivity. Pricing for these solutions are/will be based on outcomes rather than seats. There are several variants of these models including (1) acquiring, converting, and retaining fragmented demand and/or (2) enabling small companies to profitably compete with pricing or products. The latter might reduce the impact of economies of scale as a long-term moat (and thereby make demand-side feedback loops more critical). Euclid Ventures had an interesting post on this concept. In what they call a “Synthetic Roll-up”, two interconnected modalities unlock additional TAM: (a) removing vertical-specific constraints to growth and (b) leveraging economies of scale through aggregation. The former allows companies to start and grow businesses with less resources and the latter coordinates by aggregating buying power.

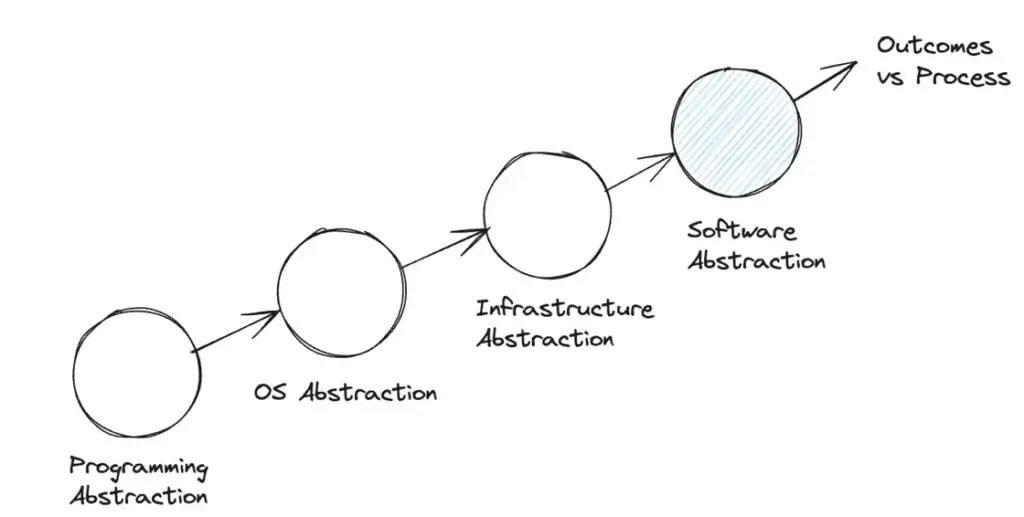

One way to reason about this trend is by analyzing the evolution of software abstraction over time. That is, the development and deployment of software has evolved in a series of layers of abstractions, reducing the complexity of building and deploying solutions. It started with programming abstraction (enabling developers to focus on higher-level coding languages versus machine code), then operating system abstraction (enabling application developers to have a standard coding environment for desktop applications, and eventually browsers), and then infrastructure abstraction (enabling developers to deploy applications globally with ease). The next abstraction will be software applications themselves, whereby the intent/outcome obfuscates the underlying software (i.e. LLM-based agentic systems aimed at particular jobs). All this points to software solutions subsuming internal and external business processes and thereby business outcomes (see The White Collar Revolution), forever changing the relationship of companies to their software. Software will no longer be a “service” bur rather the means to achieve a goal—whether that’s automating business processes, coding software, or generating content. Software-as-a-Service is shifting to Service-as-Software—from coding business logic to absorbing and optimizing business outcomes.