Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

A friend and peer of ours, Beezer Clarkson from Sapphire Partners, published an interesting post discussing the dynamics of the early-stage Seed and Series A ecosystem. This was following some discussion in the industry as to whether “VC is broken”—pessimists arguing that the bifurcation in fund sizes and the concentration of capital into very few mega funds was boxing out the longer tail of firms and driving more consensus across investments. A related concern specific to seed investors is the dominance of mega funds in seed stages. To validate this study, we analyzed our own data to confirm the figures (we ingest and normalize terabytes of data across many private market sources).

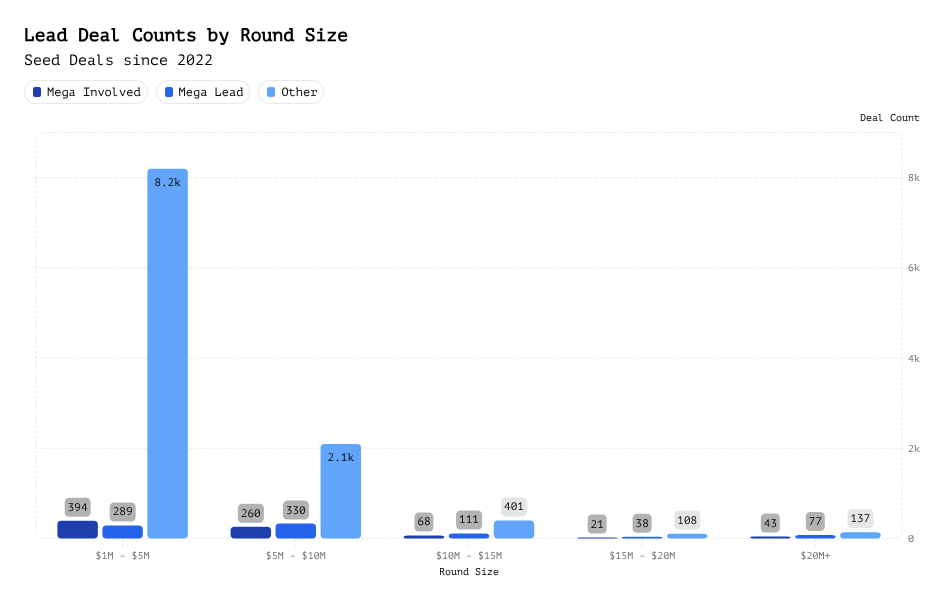

As a first step, we reviewed the distribution of lead behavior (mega-only, boutique-only, and co-lead) for all seed deals across various round size buckets. For ease of analysis, we consider mega funds to be over $1B. We find, as expected, that mega funds have an outsized market share of larger deal sizes (given their ability to deploy larger check sizes).

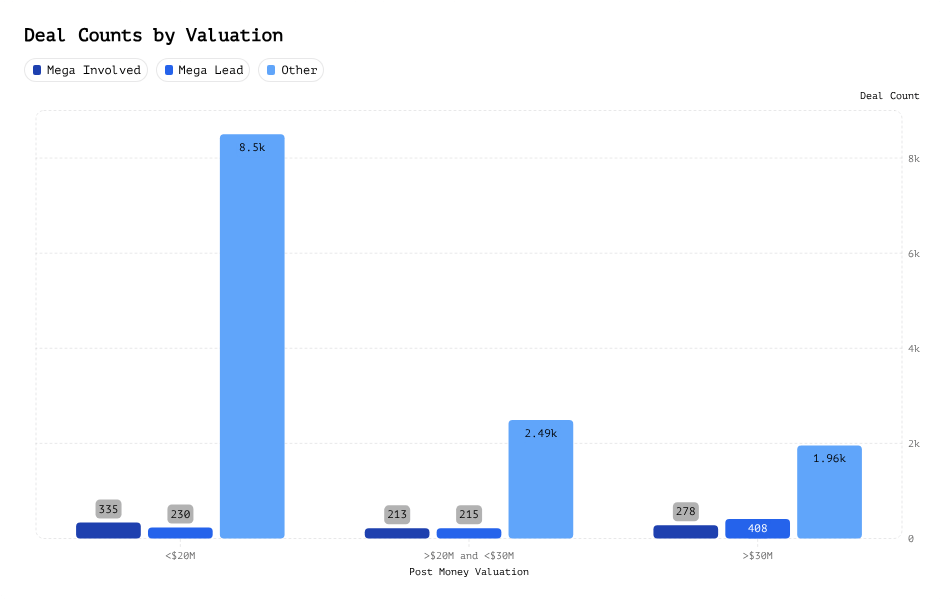

Now, if we look at the distribution of deal counts for various valuation buckets (as opposed to round size, although related), we also see a large mega fund participation rate (lead/involved) for deals >$30m valuations (~25%), which is consistent with the anecdotal data that mega funds are not valuation sensitive at the seed stage (as their incentive is to plow large amounts of capital into winners at later rounds). This of course creates an issue for boutique firms who will either be outcompeted for seed rounds or will need to pay up to participate, potentially eroding portfolio convexity (i.e. ownership relative to fund size would require massive outcomes to return multiples of the fund). We believe this is a great existential risk for boutique GPs.

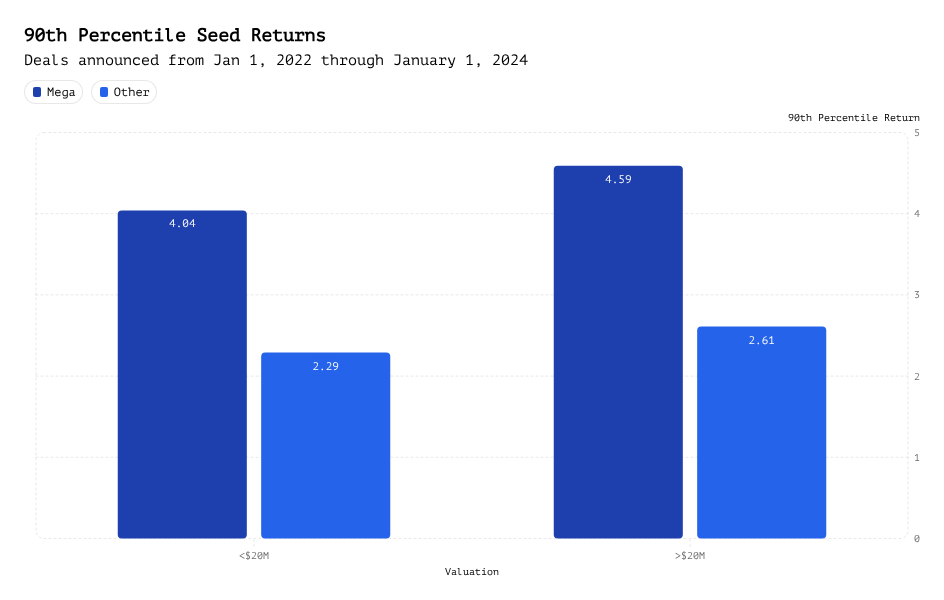

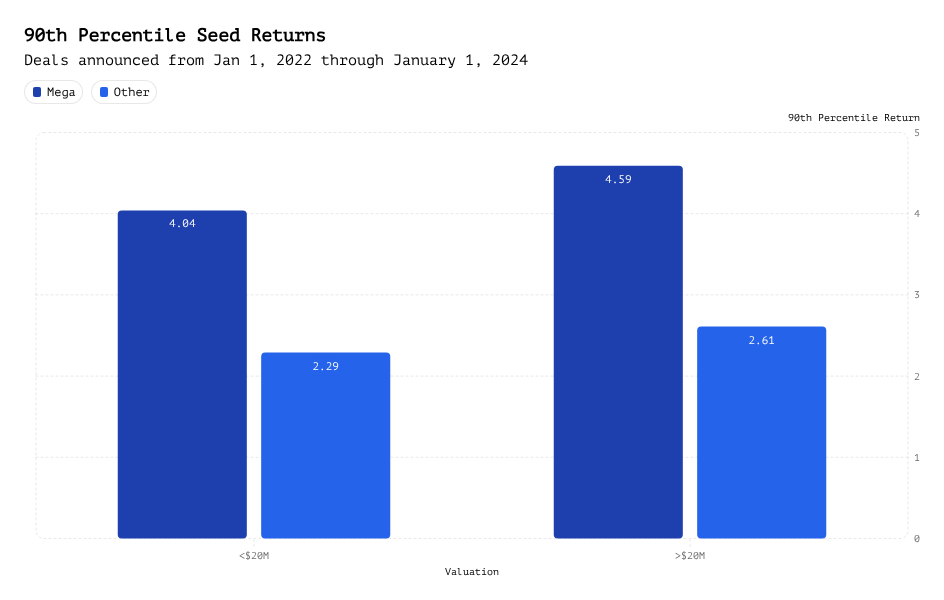

We then analyzed the returns of these seed rounds split by valuation thresholds (for rounds between 2022 and 2024). When the rounds were higher than $20m in valuation, the 90th percentile returns are ~4.6x for mega fund participation (1.75x the 90th percentile of other rounds). Interestingly, also for lower valuations rounds (<$20m) the 90th percentile returns were also higher when mega funds participate. This implies that there is more return momentum in seed rounds with mega fund participation (and also perhaps various forms of reflexivity by their very participation). Of course, early momentum does not necessarily imply long-term outperformance, as mark-up velocity does not necessarily imply total final return. We do note, however, that 99th percentile returns are mainly commensurate across all buckets, implying that the power law exists across all syndicates (but harder with non-mega participation).

We agree with Beezer’s conclusions that venture is not necessarily broken but significantly more difficult, emphasizing superior founder selection as the key moat for returns. Boutique strategies persist in all deal sizes and valuations, and their outcomes will determine long-term viability amid tightening LP capital. In addition, we believe the above analysis highlights a phenomenon we discussed in a prior post—Smart Beta versus Smart Alpha strategies. To update this perspective, there seem to be three stable states with regards to fund strategy:

More than ever, GPs need to be thoughtful about their fund strategy relative to their alpha/beta approach to the market. Unsurprisingly, AUM growth continues to be the enemy for most boutique GPs, which creates an inherent, structural conflict with certain LPs that want to deploy significant amounts into venture.