Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

In our last post we wrote about data center build-out and the potential oversupply of compute capacity. In this update, we want to dig into the relationship between price and fundamental value in today’s markets. Efficient market hypothesizers assume that price is tied to fundamental value and all information about a particular asset is implied and factored into its current price. The implication is that information flow becomes quickly absorbed into asset prices (that properly capture intrinsic value) and any informational advantage is squeezed out over time. There are many empirical studies that show deviations from market efficiency; many of these are related to behavioral human biases and non-linear dynamics that generate various types of supply/demand imbalances.

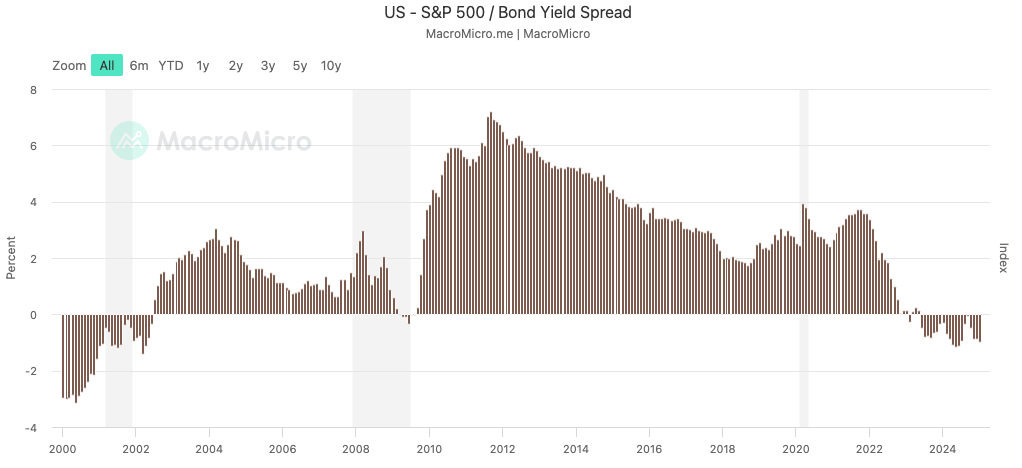

When we look at the market, it is interesting to note that the spread between S&P 500 earnings yield versus the 10Y Treasury would imply that stocks are overvalued.

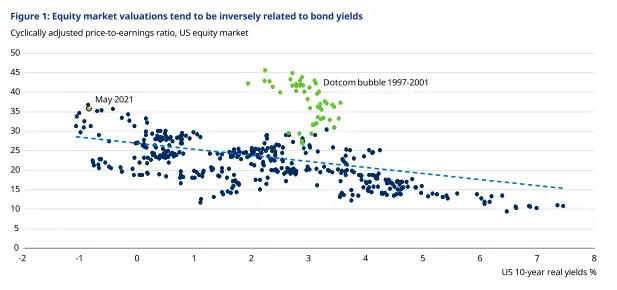

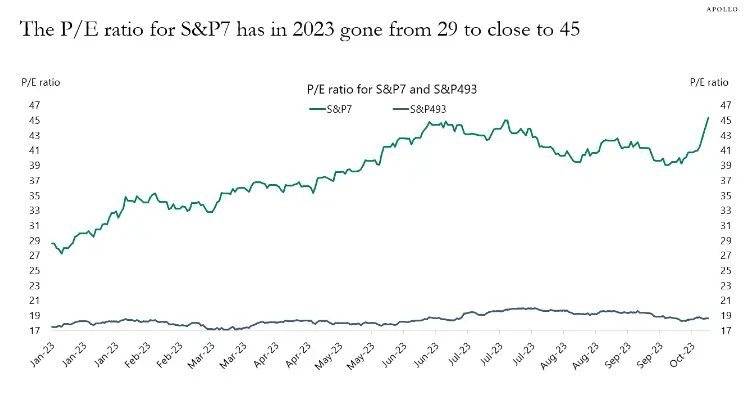

We know that historically, equity market valuations have been inversely related to bond yields, yet today we are seeing increasing bond yields with sustained high equity multiples. The S&P has delivered solid returns over the several last years, and markets have stayed the course. There is, of course, a notable amount of concentration—the Mag7 make up nearly mid-30% of the S&P 500 index and mid-20% of the MSCI World index.

We recently read research from AQR that points to the relationship between the value spread and general market inefficiency. That is, when the spread between expensive and cheap stocks is high, it can be an indicator that the market is in an inefficient regime. The research further posits that markets have become inefficient in large part due to the growth of passive investing in addition to the proliferation of social media and informational connectivity that allows information to spread quickly.

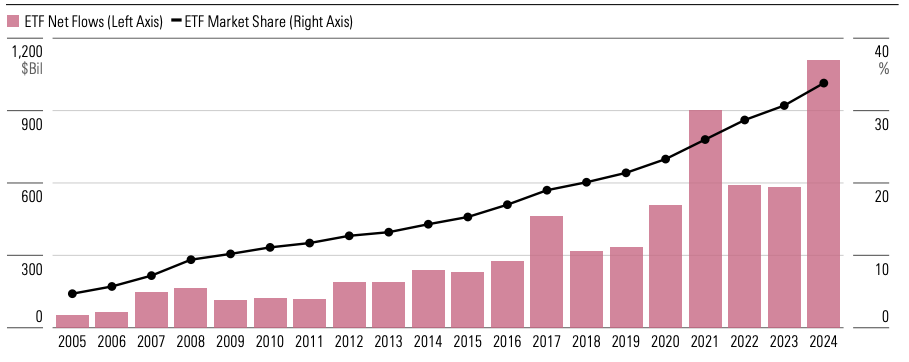

One structural feature of the market today is the large amount of passive investors (especially market-weighted indexing). Passive investors can create inelastic markets, where demand is consistent regardless of price. This creates a situation in which prices are sensitive to small changes in flows (in either direction). Inelastic markets respond to changes in fund flows (demand), which can divorce prices from fundamental values (see this research). If we look at net flows into equity (see ETF net flows below) we see significant growth in passive fund flows over the last several years.

The combination of a highly powerful narrative (AI) and an inelastic market has enabled an environment with high concentration and large value dispersion (difference between the most expensive and least expensive companies). As a result, the arrival of any high-entropy news that could impact demand, would certainly create a meaningful sell-off and negative price feedback loop—which is what occurred.

It is still too early to know how the market will evolve, but nonetheless – as a result of the dynamics discussed in our last post – a lot of value will accrue to application layer companies that leverage AI into specific use cases, as these companies will be beneficiaries of rapidly diminishing AI compute costs.