This is Not Your Mother’s Alpha

June 26, 2025

Does sector specialization impact the performance of emerging managers?

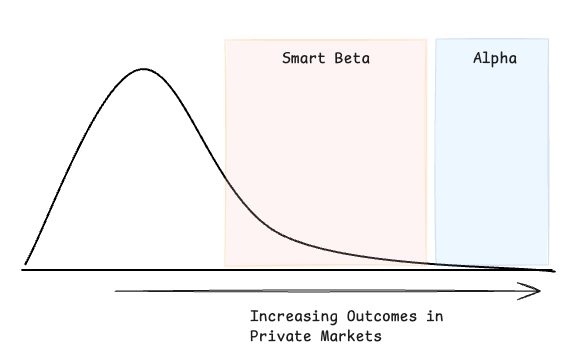

At Level, we categorize investment firms based on their investment strategies (e.g., pacing, stage, follow-on rate, lead strategy, etc.) and analyze their estimated return multiples. Results show that early-stage specialist firms younger than ten years old outperform generalists.*

| Population-Adjusted Generalist Percentile | Above Median Hit Rate | Above Top Quartile Hit Rate | Above Top Decile Hit Rate | Count |

|---|---|---|---|---|

| <25% (more specialist) | 68.0% | 45.0% | 25.0% | 100 |

| 25-50% | 67.1% | 42.6% | 13.5% | 155 |

| 50-75% | 74.1% | 40.9% | 14.5% | 166 |

| 75%< (more generalist) | 59.0% | 34.1% | 12.7% | 200 |

Portfolios at the bottom 25% of generality (i.e., more specialist) hit top-decile returns 25.0% of the time compared to portfolios with the top 25% of generality (i.e., more generalist) reaching top-decile returns 12.7% of the time, barely above random. Meanwhile, portfolios at the bottom 25% of generality have a top-quartile hit rate 32% higher than their top 25% counterpart.

This trend intensifies as we truncate the inclusion criteria to look at firms founded within four years (an approximation for Fund I/II) of the evaluation date.

| Population-Adjusted Generalist Percentile | Above Median Hit Rate | Above Top Quartile Hit Rate | Above Top Decile Hit Rate | Count |

|---|---|---|---|---|

| <25% (more specialist) | 68.0% | 45.0% | 25.0% | 100 |

| 25-50% | 67.1% | 42.6% | 13.5% | 155 |

| 50-75% | 74.1% | 40.9% | 14.5% | 166 |

| 75%< (more generalist) | 59.0% | 34.1% | 12.7% | 200 |

Highly specialist portfolios from young firms have a top-quartile hit rate of 61%, representing a 2x increase from the most generalist portfolios. Note that the broader inflation of returns in this demographic irrespective of specialization may have to do with the tendency of emerging firms to have smaller fund sizes, which drive outlier returns.

Some generalist firms may still outperform specialists. But, historically speaking, specialization seems to serve as a key ingredient in selecting winners.

Will the outperformance of specialized and small funds continue? We plan to detail our beliefs in future posts.

*Portfolio Cohorts

Cohorts are calculated as 3-year portfolio spans ending in the date of evaluation filtered to include firms that were founded within ten or four years of evaluation and had both a Pre-Seed/Seed and Series A/B initial check strategy.

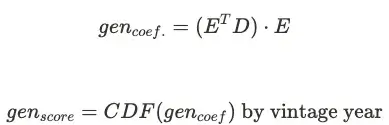

Calculating generalist coefficient:

E = portfolio exposure from initial investment counts across different topical categories T in our 60-dimensional Level topic space

D = |T|x|T| matrix where each entry represents the dissimilarity between topics

For example, for the three-year period ending in 2023 we get the following firm generalist scores:

| Investor Name | Generalist Score |

|---|---|

| Andreeseen Horowitz | 92.5% |

| Coinbase Ventures | 5.7% |

| Cerca Partners | 66.7% |

| KdT Ventures | 33.0% |

| Genoa Ventures | 3.6% |

You can also view this post on Medium here.