Mega Funds at Seed: Existential Risk or Smart Beta Opportunity?

December 18, 2025

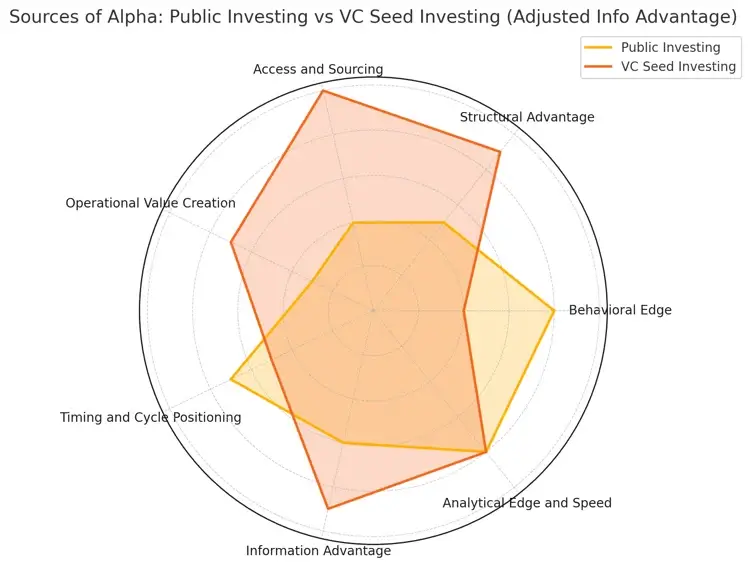

Alpha erodes over time. Since markets are complex and far from equilibrium, new sources of alpha constantly emerge and are arbitraged away. Of course, alpha is a measure of the excess return of an investor relative to a benchmark index or risk-adjusted expected return. As such, it gauges a manager’s ability to outperform the market. From a meta-perspective, there are several categorical sources of alpha depending on the asset class and sub-segment (see below):

In summary: structural advantages can include size/mandate, access and sourcing are network and brand advantages, operational value creation is post-investment value-add, timing and cycle position is ability to position capital before cycles or sector tailwinds, information advantages include asymmetric knowledge, analytical edge is data processing and speed, and behavioral edge is related to contrarianism, patience, and discipline.

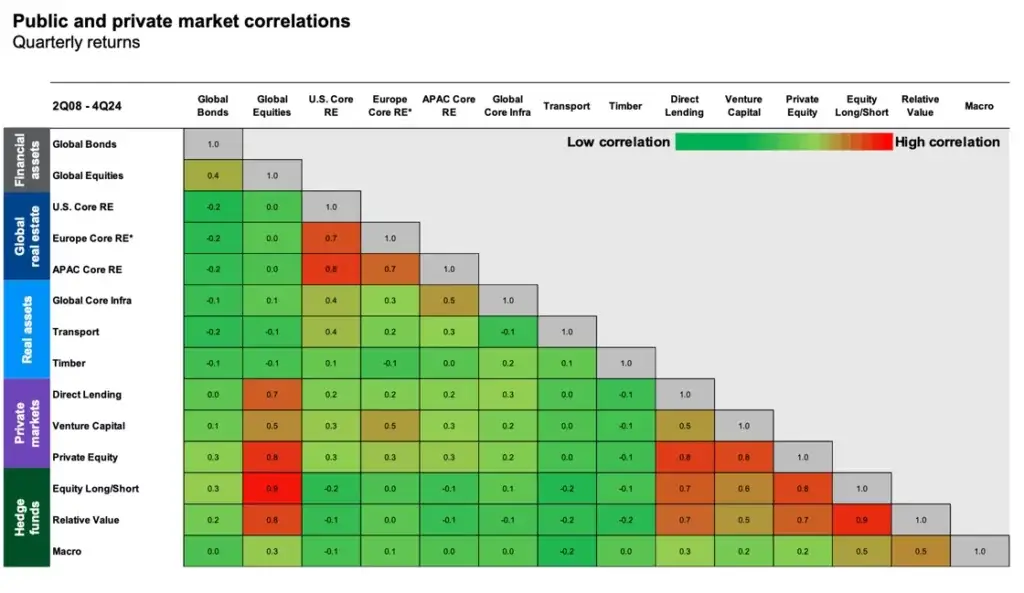

These categorical sources of alpha are dynamic and are influenced by capital flows, which in turn impact the evolution and ecology of market participants. As in all adaptive markets, participants must evolve to survive, especially as the sources of alpha shift (and as capital flows rotate). Each market or asset class has its own nuances while the alpha in each market is often uncorrelated (see below).

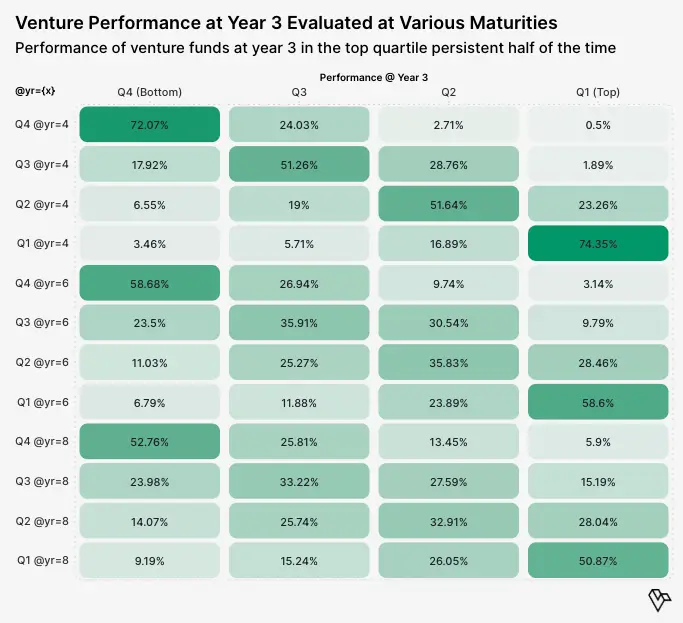

In the VC asset class specifically, alpha is hard to quantify because: (a) investments are illiquid and marked infrequently (with varying standards), (b) there is public benchmark, (c) there is idiosyncratic risk driven by outliers not in broad market exposure (in public markets, you can diversify away idiosyncratic risk by holding many stocks or neutralizing factors), and (d) non-normal return distributions (heavily skewed returns, high variance, low predictability). LPs in VC funds rely on mostly noisy benchmarks (Cambridge, PitchBook) to compare managers. The complexity is that the signal takes time and there is low intra-fund and cross-fund persistence (using Level data, below we show VC performance at year 3 evaluated at various maturities, showing 50% performance persistence of top-quartile by year 8).

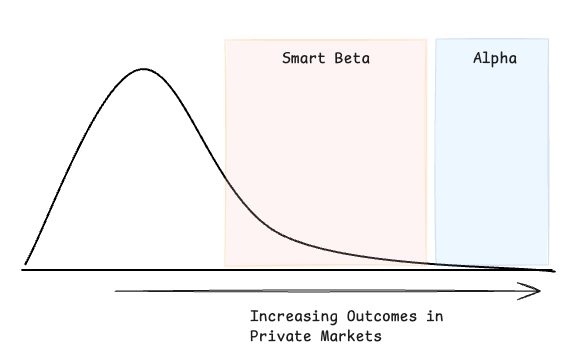

Alpha in VC is a function of where the fund sits on the convexity curve. Given today’s barbell market structure (high capital concentration in large multi-stage firms), smart beta players are able to quickly move capital into legible investment areas, and pile more capital into winners—similar to how smart beta investors in public markets capture factor premia (they systematize known sources of alpha)—so managers must now dig deeper for true alpha.

So where is the alpha in VC today?

The dynamics of alpha-generation have become harder—but alpha is also more pronounced as outcomes in private markets grow larger while companies stay private longer. Meanwhile, cycle times for innovation, networks, specialization, and startup scaling are changing faster than ever.

With this backdrop in mind, we are constantly self-reflecting on our own sources of alpha. As such, we have continued to crystallize our strategy to adapt to market evolution: